irs child tax credit 2022

October 6 2022 809 AM CBS Los Angeles. The Child Tax Credit was expanded for tax year 2021 so parents can get half of the credit early before filing their taxes in early 2022 through advanced monthly payments.

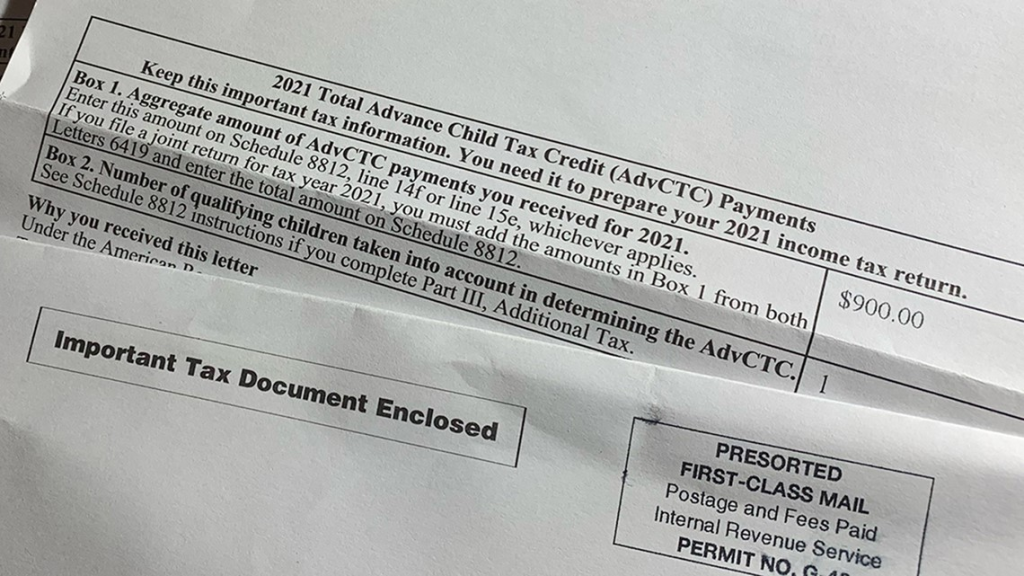

What Is Irs Letter 6419 And Why Does It Matter Before You File Taxes Where S My Refund Tax News Information

If a taxpayer did not file a return for this year then the data will be based on.

. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. To calculate the amount to claim consult your Letter 6419 Advance Child Tax Credit Reconciliation which was sent by the IRS to eligible taxpayers in late 2021 or early 2022. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

The maximum child tax credit amount will decrease in 2022. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child. Families Wont Receive Child Tax Credit on Friday For First Time in Half a Year.

Last year the IRS increased the potential payout of the Child Tax Credit to 3600 per child up from 2000 the year prior. Families will get 250 per child and a maximum of 750 total for up to three children. For your 2022 tax return the potential return per dependent aged 16.

As part of the American Rescue Act signed into law by President Joe Biden in. To be eligible for the payments residents must have filed their 2021 Rhode Island. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

Families who have filed their 2020 taxes will automatically receive the payments beginning July 15. The Internal Revenue Service is keeping its Free File program open an extra month which extends the time for eligible people to claim COVID stimulus payments including the. Have been a US.

Time is running out to claim the expanded Child Tax Credit that could bring an eligible family as much as 3600 per. Heres Why Published January 14 2022 Updated on January 14 2022 at 900 am.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

What Is The Child Tax Credit Tax Policy Center

Irs Updates Tax Year 2021 Filing Season 2022 Child Tax Credit Frequently Asked Questions Nstp

Child Tax Credit 2022 Families Can Claim Direct Payments Worth Up To 3 600 Due To Irs Mistake See If You Qualify The Us Sun

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Child Tax Credit Deadline For Congress To Extend 300 Payments Into 2022 Is In Five Days The Us Sun

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022

What Families Need To Know About The Ctc In 2022 Clasp

Irs Holds Special Weekend Events To Help People Who Don T Normally File Taxes Get Child Tax Credit Payments And Economic Impact Payments Larson Accouting

Irs Will Send Out The Last Advance Child Tax Credit Payment By December 15 2022 Where S My Refund Tax News Information

Irs Issues Information Letters To Advance Child Tax Credit Recipients And Recipients Of The Third Round Of Economic Impact Payments Taxpayers Should Hold Onto Letters To Help The 2022 Filing Season Experience

33 000 Taxpayers May Still Be Waiting For Their Child Tax Credit Ct News Junkie

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

New Expanded Monthly Child Tax Credit Maine Immigrants Rights Coalition

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj